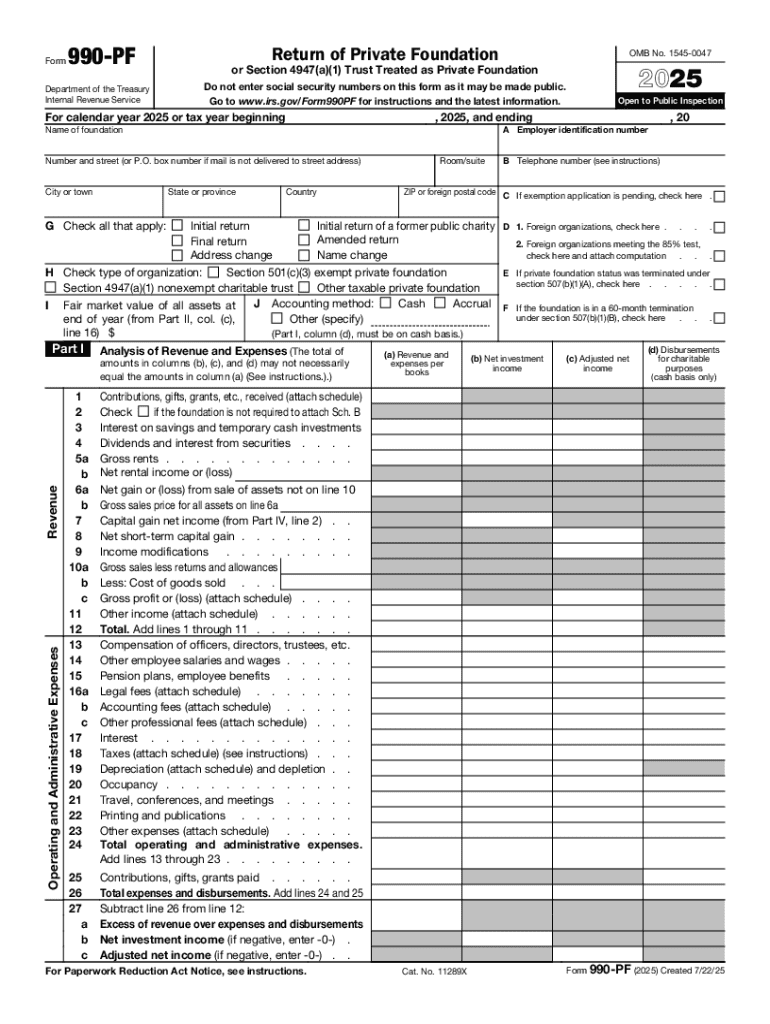

IRS 990-PF 2025-2026 free printable template

Instructions and Help about IRS 990-PF

How to edit IRS 990-PF

How to fill out IRS 990-PF

Latest updates to IRS 990-PF

All You Need to Know About IRS 990-PF

What is IRS 990-PF?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990-PF

What should I do if I realize I've made a mistake on my IRS 990-PF after submission?

If you discover an error on your IRS 990-PF after filing, you should prepare an amended return to correct the mistake. Ensure you reference the original filing year and clearly identify the changes made. It's essential to submit the amended form as soon as possible to avoid potential penalties.

How can I check the status of my filed IRS 990-PF?

To verify the status of your submitted IRS 990-PF, you can contact the IRS directly or utilize their online services. Be prepared to provide your pertinent information such as the Entity Identification Number (EIN) and the tax year you are inquiring about. It's advisable to check this after the IRS processing time has elapsed.

Are there any specific legal considerations I should be aware of when filing an IRS 990-PF?

When filing your IRS 990-PF, it's important to consider e-signature acceptability and the requirement for maintaining records for a specified duration. Ensure that you adhere to privacy and data security standards to protect sensitive information included in your submission.

What common errors should I avoid when filing my IRS 990-PF?

Some typical mistakes to avoid on your IRS 990-PF include failing to provide accurate financial information, neglecting to include necessary supplementary schedules, and overlooking the significance of the public disclosure requirements. Reviewing your completed form thoroughly can help eliminate these errors.

What steps should I take if I receive a notice regarding my IRS 990-PF filing?

If you receive a notice related to your IRS 990-PF filing, read it carefully to understand the issue. Respond promptly with the required documentation and any requested information. If the notice indicates an audit, prepare relevant records that support the information declared on your form.

See what our users say